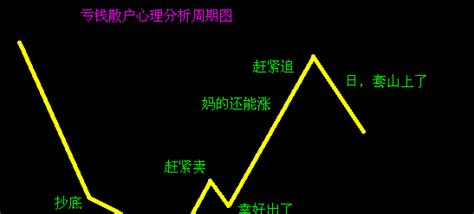

散户心理和行为学的关系

Title: Understanding the Psychology and Behavior of Retail Investors

In the world of finance, retail investors play a crucial role in shaping market dynamics. Their decisions, often influenced by psychological factors, can impact asset prices and market trends. Understanding the psychology and behavior of retail investors is essential for market participants, regulators, and even individual investors themselves. Let's delve into this fascinating subject.

1. Herd Mentality:

Retail investors are susceptible to herd mentality, where they tend to follow the actions of the majority without critically analyzing information. This behavior often leads to exaggerated market movements and asset bubbles. To mitigate the risks associated with herd mentality, investors should focus on conducting thorough research and forming independent opinions.

2. Loss Aversion:

Loss aversion refers to the tendency of investors to strongly prefer avoiding losses over acquiring gains of an equivalent magnitude. This psychological bias can lead to irrational decisionmaking, such as holding onto losing positions for too long in the hope of breaking even. To overcome loss aversion, investors should adopt disciplined risk management strategies and maintain a longterm perspective.

3. Overconfidence Bias:

Many retail investors exhibit overconfidence bias, believing they possess aboveaverage abilities in stock picking or market timing. This unwarranted confidence often leads to excessive trading and poor investment outcomes. To counter overconfidence bias, investors should acknowledge their limitations, seek advice from financial professionals, and diversify their portfolios to reduce risk.

4. Confirmation Bias:

Confirmation bias occurs when investors seek out information that confirms their existing beliefs while ignoring contradictory evidence. This tendency can result in distorted decisionmaking and missed opportunities. To combat confirmation bias, investors should actively seek out diverse perspectives and remain open to changing their views based on new information.

5. Regret Aversion:

Regret aversion refers to the desire to avoid making decisions that may result in remorse. Retail investors may avoid selling losing investments to prevent the regret of realizing a loss. However, this behavior can lead to holding onto underperforming assets for too long, further exacerbating losses. To address regret aversion, investors should focus on making rational, forwardlooking decisions based on their investment goals and risk tolerance.

6. Behavioral Biases in Trading:

Retail investors often exhibit behavioral biases in their trading activities, such as the disposition effect (tendency to sell winners too early and hold onto losers too long) and the endowment effect (overvaluing assets simply because they own them). Recognizing these biases can help investors make more rational trading decisions and avoid common pitfalls.

7. Importance of Investor Education:

Education plays a vital role in mitigating the influence of psychological biases on investor behavior. By understanding the principles of finance, risk management, and behavioral economics, investors can make more informed decisions and navigate volatile markets with greater confidence. Financial literacy initiatives and investor education programs are essential for empowering retail investors to achieve their financial goals.

Conclusion:

The psychology and behavior of retail investors significantly impact financial markets, often leading to inefficiencies and market anomalies. By recognizing common behavioral biases and adopting disciplined investment strategies, investors can enhance their decisionmaking process and improve their longterm investment outcomes. Moreover, ongoing education and awareness initiatives are essential for promoting a culture of informed investing and safeguarding against the pitfalls of irrational behavior.